Pitkin County’s Per Capita Income Thir...

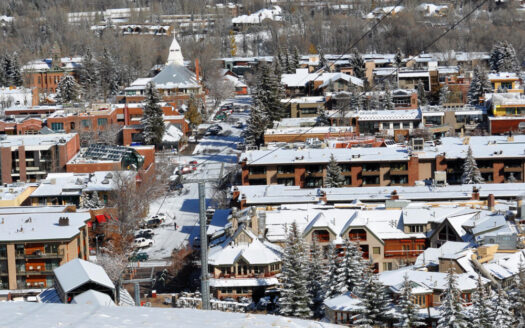

Aspen, Colorado – a playground for the wealthy, a picturesque haven for outdoor enthusiasts, and now, the home to t ...

Balance & Harmony In Business With The ...

The golden rectangle is a geometric concept derived from the golden ratio, a mathematical ratio often denoted by th ...

Unveiling Success: Strategies for Opening a ...

Introduction: Aspen, Colorado, nestled in the heart of the Rocky Mountains, is not just a winter wonderland for ski ...

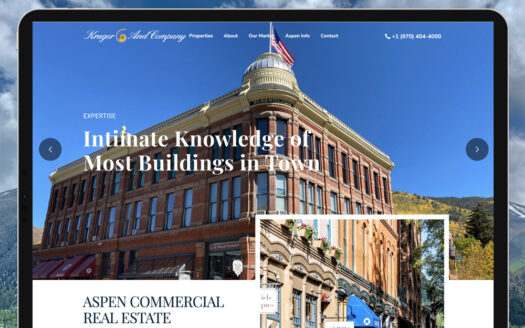

Kruger And Company’s Cutting-Edge Webs...

In the heart of Aspen, a city renowned for its picturesque landscapes, thriving businesses, and vibrant arts scene, ...

Crafting a Successful Retail Store Concept i...

Nestled amidst the breathtaking beauty of the Rocky Mountains, Aspen, Colorado, is not only a hub for outdoor enthu ...

Getting The Best Commercial Lease

When considering a commercial real estate lease for a retail store in Aspen, Colorado, several key factors should b ...

FIABCI-USA Unites in Denver

FIABCI-USA 2023 Grand Prix & Fall Membership Meeting Last weekend, FIABCI-USA united in Denver for an unforgett ...

Hero’s Terrain Expansion on Aspen Moun...

After nearly 30 years of planning and negotiating with the Forest Service and the County, Aspen Skiing Company is f ...

Opening A Restaurant in Aspen

Opening a restaurant is a big decision, opening one in Aspen is the stuff of dreams with the potential for great re ...

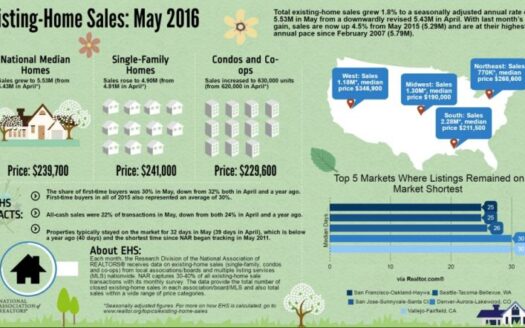

Existing-Home Sales at Highest Pace in 9 Yea...

Existing-Home Sales at Highest Pace in 9 Years Daily Real Estate News | Wednesday, June 22, 2016 All major U.S. reg ...